Forex spread refers to the difference between the exchange rate at which a broker sells a currency and the rate at which the broker buys the currency. The key to understanding spread involves the concept of trading in pairs. Every time a trader either buys or sells a currency, the trader will also buy/sell the second currency from the pair in the opposite direction.

The price at which the broker sells the currency is also known as the bid price. In contrast, the price at which they buy the currency is the asking price.

Understanding forex spread is essential for anyone that is looking to invest in the forex market. Yes, that means you! It involves trading a specific currency for another at a predetermined exchange rate. As a result, the price of currencies is available in relation to other currencies in the exchange market.

Now that you know the basic definition of forex spread, let’s jump into a little more detail.

The Importance of Spread in Forex Trading

Spread is a critical part of trading as it can represent the difference between profit and loss. Ultimately, it determines how profitable your trades are, or how much loss you incur. Every trade starts at a loss (once the spread is paid to the broker), so making sure the loss is minimal will have a major impact on the potential success of your trading activity.

Types of Forex Spreads

One aspect that confuses people about forex spreads is the different types available on the market. There are two main types of spreads:

- variable

- fixed

Let’s take a closer look at the various attributes of each type of spread.

Variable Spread

- Another term for variable spread is floating spread

- It refers to a constantly changing value between the ask and bid prices

- Essentially that means that the potential spread to pay for purchasing a currency will fluctuate depending on supply, demand, and total trading activity

- Typically, brokers that promise tight spreads tend to offer variable spreads

- It’s possible that the spread the client purchases has the exact value that the broker advises, but it isn’t always the case

- Generally, spreads will be tighter during active trading sessions as liquidity is optimal

Fixed Spread

- Fixed spreads are the complete opposite of variable spread

- The ask and bid prices remain the same even if the prices change

- Fixed spread shows no sort of fluctuation due to market conditions

- The spreads tend to be a lot more stable than variable spreads

How to Calculate Spread In Forex?

To start making money in the forex, investors need to know in-depth how to calculate the spread. Pip is short for price interest point, and it refers to the movement of prices at a predetermined exchange rate. Using this value allows traders to manage their trading strategy accordingly to earn the most profits.

The pips will measure any sort of movement in the exchange rate. Investors can calculate the value of a pip by diving 1/10,000 from the exchange rate. Take, for example, an investor that wants to purchase the USD/CAD pair. They would be buying US dollars and selling Canadian dollars at the same time. If the investor wanted to sell US dollars, they’ll sell the USD/CAD pair and buy Canadian dollars at the same time.

A common way traders use the term “pips” is to talk about the spread between the bid and ask price of the currency pair. It can help indicate what gains or losses could come around from a trade.

Typically, currency pairs are quoted in four decimal places, so investors can calculate a pip by dividing 1/10,000 from the exchange rate. However, there are certain exceptions. Japanese Yen pairs are quoted according to 2 decimal places. In that case, for the currency pairs of EUR/JPY and USD/JPY, the value of pip equals 1/100 divided by the exchange rate.

Why Does A Spread Fluctuate?

Several factors can influence the forex spread. One of the most common factors is market volatility. The level of volatility in the market will affect how much any sort of activity will impact the spread. That’s why investors must keep an eye on the economic calendar so they can identify the opportunity for wider spreads.

Investors can take advantage of fluctuation by staying informed of the events, which might cause currency pairs to become less liquid. However, it’s always difficult to predict everything correctly. Any potential breaking news or economic data can make it challenging to prepare for everything.

Another major factor that impacts the spread is the level of liquidity in the market. The greater volume that flows through the market at a specific time, the narrower the spread. That’s why during the market’s busiest hours, the spread will tend to be narrower. By actively participating in the market, investors will become more aware of how the forex spread fluctuates.

How to Find Low Spread Brokers?

Another factor that new investors need to consider is that not all forex brokers are the same. Certain brokers will offer better forex spreads for specific trading instruments. In contrast, others might offer better pricing during peak teams. Using trustbroker.com can allow investors to see which broker is the most suitable for their trading style.

TrustBroker allows investors to check their broker against other popular brokers on the market. Clients can access some of the best popular forex brokers on the market by following three easy steps.

Time needed: 5 minutes.

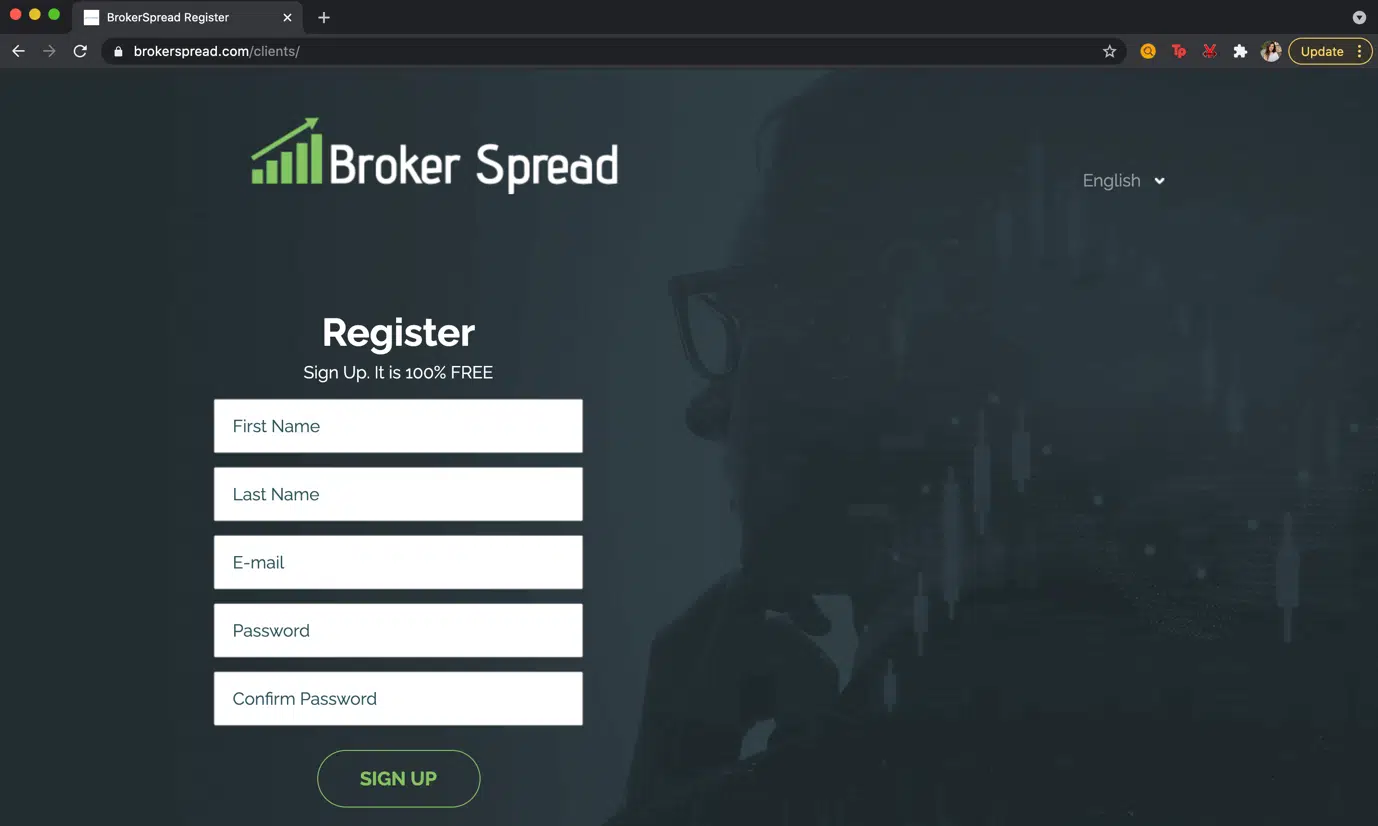

- Create a Free Account

Investors can click here to access the broker spread registration page. The sign-up procedure is straightforward. Clients will need to add in their first name, last name, and email. Then they must choose a password and confirm the same password.

After that, trustbroker.com will redirect clients to a verification page that will ask them to verify their account from the email address. After the verification is complete, clients will be asked to log in to their account again and access the dashboard.

- Upload the MT4 Trading History File

To upload the MT4 file, clients must first save the statement from MT4. To save the report, clients must access the MT4 terminal and follow these instructions. There will be an option to export the file in .htm format. After getting access to the file, clients can upload it on the dashboard to generate the spread comparison report.

- Generate broker spread comparison report

Clients can upload their MT4 history file or individually enter trades. That will allow traders to get access to a detailed report. The report will contain information comparing the traders’ broker spreads to other top forex brokers in the market.

Using the report, investors can quickly determine whether they should stick with the current broker or switch to a new one.

Conclusion

This small guide should help you understand forex spreads a little bit better. Learning more about forex spreads will help you establish a profitable trading strategy. If you’re not satisfied with the current spread you’re getting or are just curious about what’s out there, TrustBroker can help you as well! So, get the most out of your money and trade smartly.

Deprecated: File Theme without comments.php is deprecated since version 3.0.0 with no alternative available. Please include a comments.php template in your theme. in /home/trustbroker.com/public_html/wp-includes/functions.php on line 6078

RELATED ARTICLES

16 Jun 2022

Forex Day Trading Risk

Forex day trading is one of the most popular ways of trading in financial markets that involves buying and selling a financial asset within a single day. Newbie traders often […]

18 Feb 2022

How to Fix MT4 Common Error

Traders often experience “MT4 common error” issues, especially while connecting the platform to the trading server. Your trading platform is warning you that it is unable to use all types […]

11 May 2022

What is trading risk management?

Trading risk management is a strategy or system assessing the potential risks of investing or allocating funds in a business or service and determining necessary steps to maintain an ideal […]